salt tax cap repeal 2021

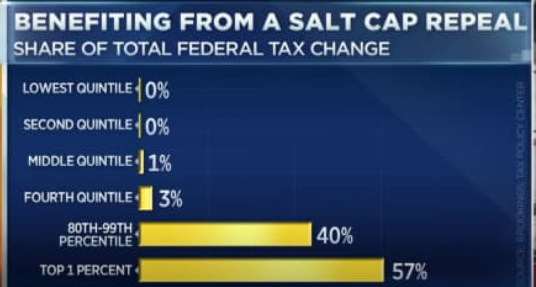

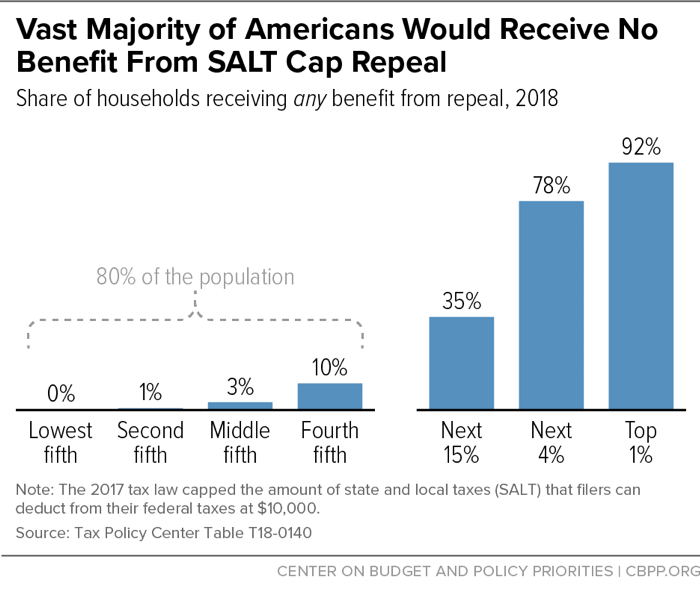

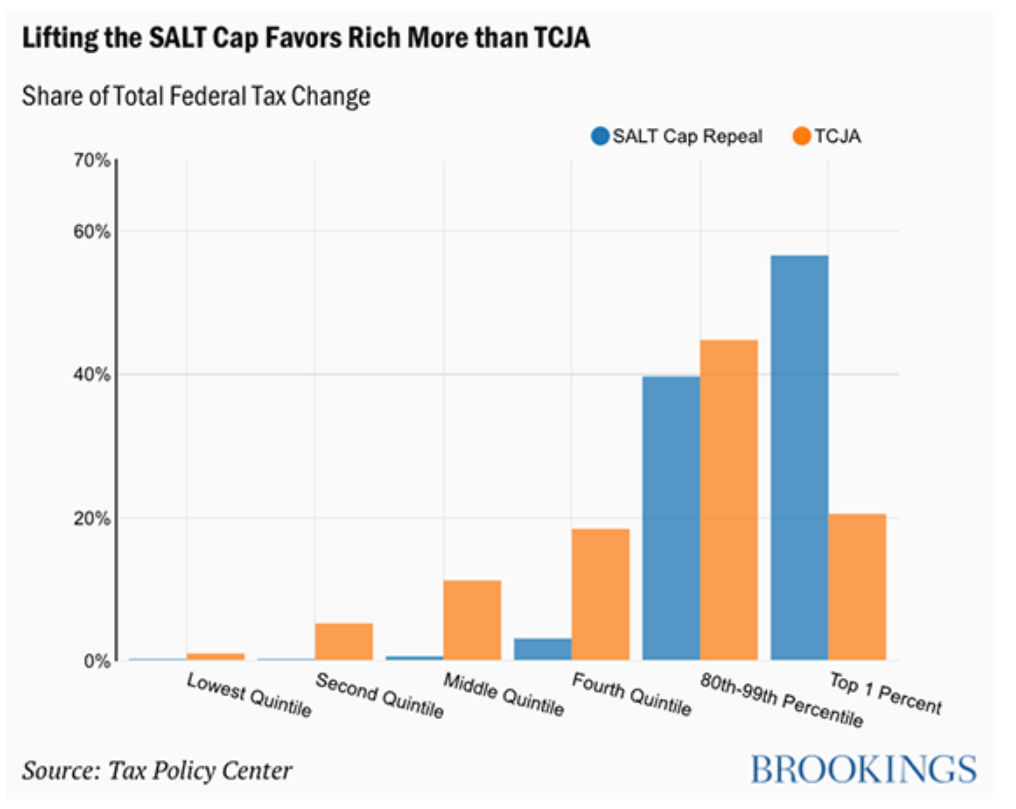

29 press conference the middle-class homeowners shared their stories of tax increases due to the 10000 SALT cap part of the Tax Cuts and Jobs Act TCJA of. All three options would primarily benefit higher-earning tax filers with repeal of the SALT cap increasing the after-tax income of the top 1 percent by about 28 percent.

House Bill To Temporarily Repeal Salt Deduction Cap To Get Floor Vote The Hill

As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a.

. This significantly increases the boundary that put a cap on the salt deduction at 10000 with the tax cuts and jobs act of 2017. A host of moderate Democrats say they wont support President Joe Bidens 35 trillion package without a repeal of the cap on state and local tax deductions known as SALT. By Ana Radelat November 4 2021 900 am.

By Laura Davison News April 15 2021 at 0253 PM Share Print. Full repeal of the SALT cap is the worst option of all. In 2018 Booker would have been eligible for a 36026 SALT deduction based on the state and local taxes he paid yet because of the SALT cap he was only able to write off.

Elrich says not so fast on SALT tax cap repeal. Combining SALT cap repeal with reinstatement of the Pease limitation and the prior-law AMT substantially reduces those benefits for high earners resulting in a 08 percent. It allows people to deduct payments like state income and local property taxes from their federal tax bills.

The tax cuts and jobs act imposed a 10000 cap on the itemized deduction for state and local taxes from 2018 through 2025. The cap on the SALT deduction. At the Oct.

The SALT cap workaround was enacted in 2021 in California and allows for business taxed as S corporations or partnerships to choose to pay a 93 state income tax. We examine how the repeal of the state and local taxes SALT cap in 2021 would affect federal revenue and the tax liabilities of taxpayers in each of the 50 states. Salt Tax Cap Repeal 2022.

This cap remains unchanged for your 2021 taxes and it will remain the same in 2022 if Congress doesnt remove the cap in its spending bill. The deduction previously unlimited was capped at 10000 as part. Various proposals are under discussion in Congress this week.

Financial Planning Tax Planning. SALT cap repeal is no middle-class tax cut New York the top 1 percent would get a tax cut of about 103000 on. Salt Tax Cap Repeal 2021.

SALT-Cap Repeal Gains Momentum. WASHINGTON DC A group of New York lawmakers in a bi-partisan effort are pushing for a repeal of the 10000 cap placed on the State and Local Tax deduction better.

N J Lawmakers Pepper Congress With Pleas For Salt Tax Break New Jersey Monitor

Wealthy Democrat Donors Likely To Benefit From Democrats Repeal Of Salt Cap Fox Business

Liberal Democrats Push To Repeal Salt Tax Cap Will Only Benefit Wealthy Washington Times

Could The State And Local Property Tax Salt Deduction Limit Be Repealed In 2022 Under The New Stimulus Bill Aving To Invest

Democrats Salt Headache Hangs Over Budget Reconciliation Bill Roll Call

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

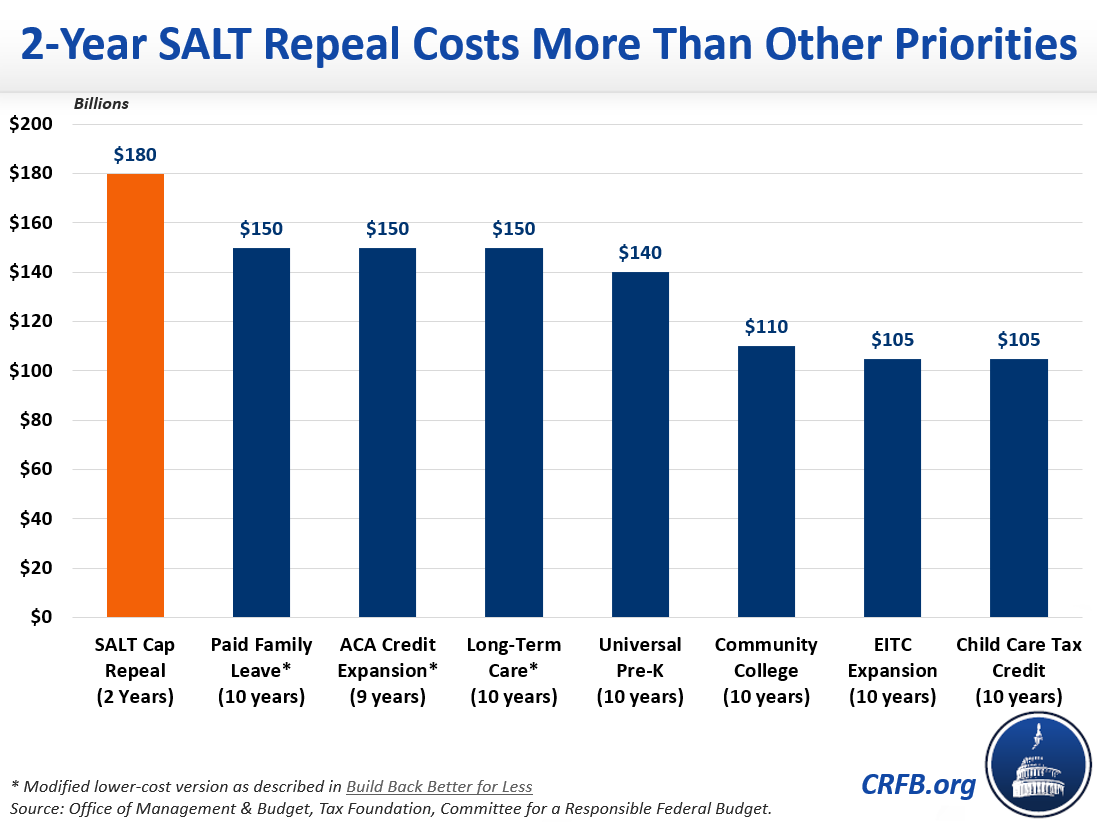

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

How A Change To The Salt Cap Would Affect Taxpayers By State Bond Buyer

Salt Deduction Cap Durbin Duckworth Restate Call For Repeal In D C Memo Crain S Chicago Business

Salt Deduction Cap Repeal Gottheimer And Suozzi Discuss Tax Cuts

The Heroic Congressional Fight To Save The Rich

Salt Cap Workarounds Will They Work Accounting Today

House Lawmakers Launch Group To Fight For Salt Cap Repeal Route Fifty

Marc Goldwein On Twitter 96 Of The Benefit Of The Salt Cap Deduction Repeal Would Go To Folks In The Top Quintile This Is Not A Middle Class Tax Cut Https T Co 2xnupxnvhd

Dems Want To Repeal Salt Cap So They Can Hike State Taxes

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Salt Break Would Erase Most Of House S Tax Hikes For Top 1 1

Sanders Rips Pelosi Schumer For Backing Repeal Of Salt Cap

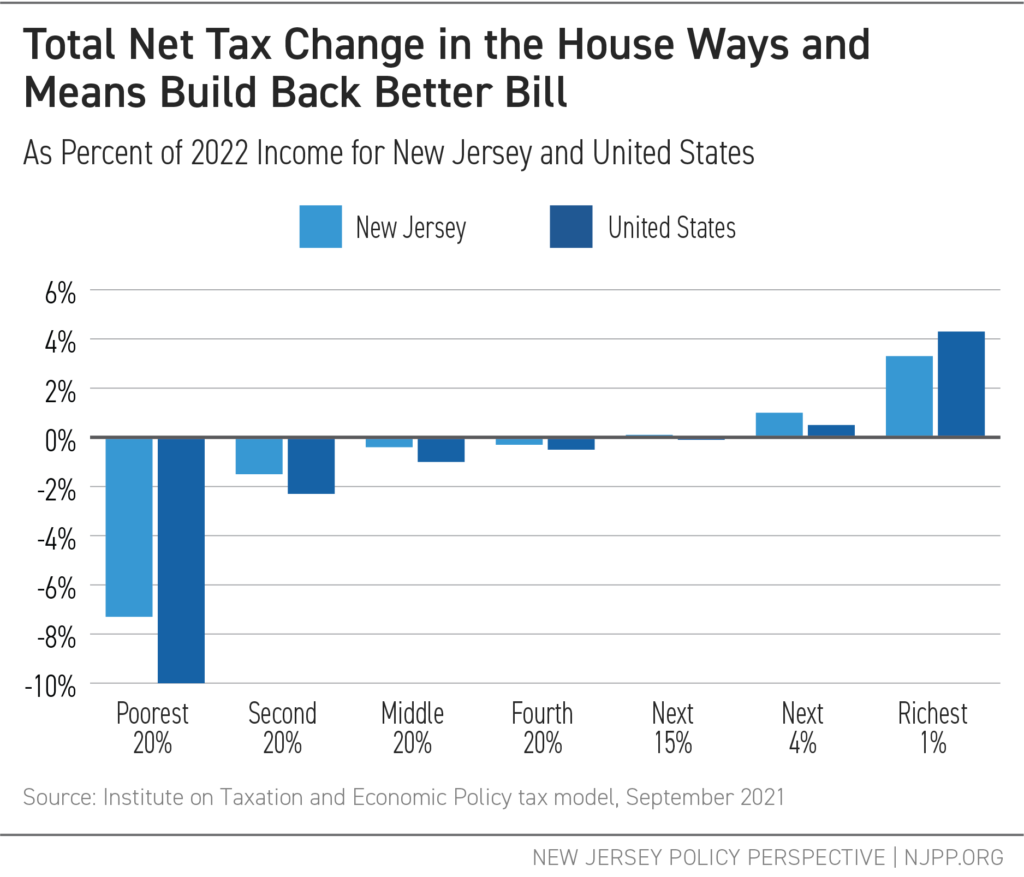

Build Back Better Legislation Makes The Tax Code Fairer But Only If Salt Cap Stays In Place New Jersey Policy Perspective